Cheap credit continues to buoy overvalued countries in Europe, but gravity is tugging on those markets.

Downdraft

And then there is the exchange rates...

|

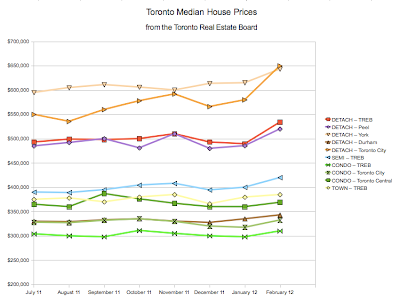

| chart from: clicks and mortar |

Downdraft

The price-to-rent ratio now indicates that Canadian properties are 76% overvalued, though things look less bubbly on the income measure and Canadian lenders are a far more disciplined bunch than pre-crisis American lenders were.The notion of discipline apparently doesn't extend to loaning money far outside the range of reasonable economic value. Not sure why not. Walk-aways are linked to overpaying, not to quality of mortgage qualification.

And then there is the exchange rates...

Consider London. Homes there may feel as expensive as ever to Britons, but a large sterling depreciation means houses look some 15% cheaper to foreigners now than they did five years ago.